|

ATA - Gonxhja: 'EXPO Albania' trade fair destination, Tirana to establish itself as a regional leader

TIRANA, April 25/ATA/ Minister of Economy, Culture and Innovation, Blendi Gonxhja, stated on Thursday that “EXPO Albania” will be a destination for organizing trade fairs,... |

|

NNA - فوز الرياضي بيروت على غوركان الايراني في المبرتت الاولى من الدور النهائي لمنطقة الغرب آسيا في كرة السلة

وطنية - تقدم الرياضي بيروت بطل لبنان في كرة السلة، ضيفه غوركان الايراني 1 - 0 من ثلاث مباريات ممكنة بينهما في الدور النهائي لمنطقة الغرب، من دوري ابطال غرب آسيا في كرة السلة "وصل"، الذي ينظمه الاتحاد الآسيوي تحت اشراف الاتحاد الدولي "فيبا". ... |

|

ANSA - إيطاليا: سعر كوب القهوة يرتفع إلى 1.20 يورو

(أنسامد) -أبريل 24-روما- انعكس ارتفاع أسعار القهوة فى الأسواق العالمية بشكل مباشر على ميزانيات الإيطاليين مما أدى الى إرتفاع سعر الكوب الكلاسيكى المقدم فى الكافيه .

ويقول موقع 'اسوتنتى' الذى يقدم بيانات عن أسعار التجزئة والاستهلاك ان أسعار الإسبريسو قد زادت بشكل كبير خلال السنوات الأخيرة... |

|

NNA - Canada - Lebanon - FAO partnership forum on agriculture and food security

NNA-Under the Patronage of H.E. Dr Abbas Al Hajj Hassan, Minister of Agriculture, the Embassy of Canada,the Food and Agriculture Organization of the United Nations(FAO),... |

|

ANSA - افتتاح مطاعم تحمل العلامة التجارية صوفيا لورين في اليابان

(أنسامد) - أبريل 24 - روما - سيتم افتتاح مطاعم تحمل العلامة التجارية صوفيا لورين في اليابان بفضل اتفاقية الترخيص المبرمة بين شركة لاند بيزنيس ليمتيد طوكيو، وهي شركة مدرجة في بورصة طوكيو، وشركة دريم فوود إس أر إل التابعة لرجل الأعمال الإيطالي لوتشانو تشيمينو.... |

|

ANSA - برديات هيركولانيوم تكشف عن مكان دفن أفلاطون

(أنسامد) - أبريل 24 - روما - كشفت برديات هيركولانيوم، عن مكان دفن أفلاطون في الأكاديمية الأفلاطونية في أثينا، حسبما قال الباحث الإيطالي جراتسيانو رانوكيا، الخبير في جامعة بيزا. ... |

|

NNA - 'الهيئة الوطنية لشؤون المرأة' افتتحت سلسلة اجتماعات افتراضية للشبكة الوطنية للنساء بلقاء عن 'المساواة بين الجنسين ومفاهيمها'

وطنية- افتتحت 'الهيئة الوطنية لشؤون المرأة اللبنانية' وهيئة الأمم المتحدة للمرأة، بالتعاون مع برنامج الأمم المتحدة الإنمائي وبدعم من السفارة الكندية في لبنان، سلسلة اجتماعاتها الافتراضية، باللقاء الأول عن "المساواة بين الجنسين ومفاهيمها"، وذلك في إطار متابعتها ل"لقاء الشبكة الوطنية للنساء في صنع القرار المحلي"،... |

|

NNA - Head advocates for Green Media, promotes environmental awareness in Lebanon

NNA - In a concerted effort to bolster environmental consciousness and action, a collaborative initiative spearheaded by the Human Environmental Association for Development “HEAD” ... |

|

ANSA - عرض ثلاث جداريات جديدة فى أسكولى بيتشينو

(أنسامد) - أبريل 24 - روما - بدأت جهود توسيع المشروع الفنى الحضارى بعنوان "السماء المفتوحة" فى مدينة أسكولى بيتشينو من خلال عرض ثلاثة أعمال جدارية جديدة فى إطار برنامج "فن عام".

ويقام المشروع برعاية بلدية المدينة مع جامعة كاميرينو وجامعة أسكولى ومؤسسة أسكولى الثقافية. ... |

|

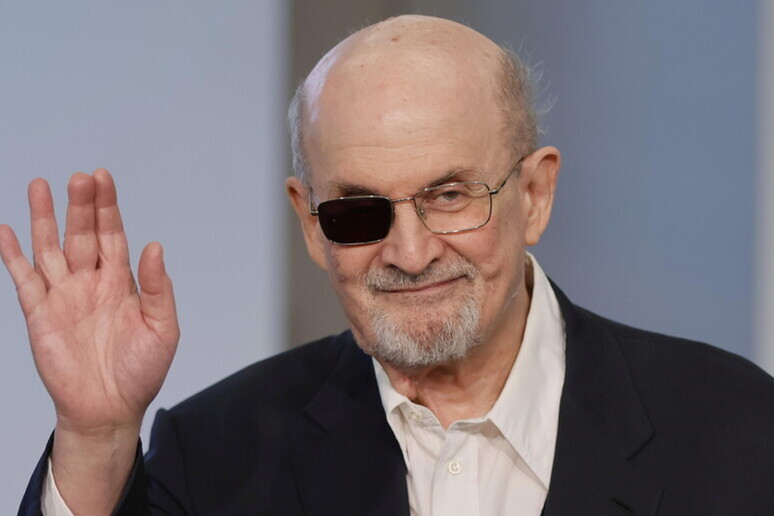

ANSA - سلمان رشدي يحضر معرض تورينو للكتاب

(أنسامد) - أبريل 24 - روما - سيكون الروائي الإنجليزي الهندي سلمان رشدي حاضرًا في معرض تورينو للكتاب، حيث سيتحدث مع مؤلف سلسلة جومورا روبرتو سافيانو، يوم الجمعة 10 مايو الساعة 6.30 مساءً.

أعلنت ذلك المديرة أنالينا بينيني في قاعة مركز المؤتمرات. ... |

|

NNA - ‘Fondation Diane’ et le 'waste diversion management consortium' lancent un projet pilote révolutionnaire pour faire face à la crise des déchets au Liban

ANI-Dans une tentative de prévenir et d'atténuer la crise anticipée, "Fondation Diane" et le "Waste Diversion Management Consortium" ont organisé le lancement officiel du Consortium... |

|

NNA - افتتاح 'الأيام البحثية الوطنية لدراسات الدكتوراه' في جامعة الكسليك

وطنية - افتتح المعهد العالي للدكتوراه بالتعاون مع المركز الأعلى للبحوث في جامعة الروح القدس- الكسليك، نشاطا بعنوان "الأيام البحثية الوطنية لدراسات الدكتوراه" بنسخته الثانية، برعاية وزير التربية والتعليم العالي في حكومة تصريف الاعمال الدكتور عبّاس الحلبي، ممثلا بالافتتاح بمدير عام التعليم العالي الدكتور مازن... |

|

Lusa - Business News - Portugal: Vinhos Verdes refuse 'reduction' government calls for

Porto, April,25,2024(Lusa)- The president of the Viticulture Commission of the Vinho Verde Region (CVRVV) on Thursday reacted to the reduction that the minister of agriculture... |

|

CNA - مسؤول الانتخابات: لا توجد اعتراضات على مرشحي انتخابات البرلمان الأوروبي

أعلن مسؤول الانتخابات أن فترة الاعتراض على المرشحين لانتخابات البرلمان الأوروبي المقبلة انتهت اليوم، وأنه لم يتم تقديم أي اعتراضات على الترشيحات.

أضاف، أن جميع الترشيحات المقدمة أمس تم الانتهاء منها وسيتم إدراجها في بطاقات الاقتراع لانتخابات 9 حزيران/يونيو. ... |

|

CNA - القبارصة اليونانيين والقبارصة الأتراك يؤيدون الجهود المبذولة لاستئناف المحادثات القبرصية

قال البيان المشترك لرؤساء وممثلي الأحزاب القبرصية اليونانية والقبرصية التركية في الحوار الذي تم بين الطائفتين برعاية سفارة الجمهورية السلوفاكية في نيقوسيا في 25 نيسان/أبريل في ليدرا بالاس، إنه ينبغي استغلال الفرصة الحالية لاستئناف المفاوضات لإيجاد حل للمشكلة القبرصية بشكل فعال من خلال المشاركة النشطة... |

|

CNA - الرئيس يؤكد أن معالجة التحديات الناتجة عن الطاقة هي الهدف الأكبر للاقتصاد التنافسي

قال رئيس الجمهورية نيكوس خريستوذوليديس إن المشكلة الأولى التي تواجهها قبرص من أجل المستقبل، هي معالجة التحديات الناشئة عن الطاقة، فيما يتعلق بالهدف الأكبر المتمثل في تعزيز مرونة الاقتصاد القبرصي وقدرته التنافسية. ... |

|

Lusa - Business News - Portugal: Namibia bus accident that killed two nationals also injured 16 others

Lisbon, April,25,2024 (Lusa) - The accident in Namibia on Wednesday involving buses carrying tourists that killed two Portuguese women caused injuries to 16 other nationals,... |

|

CNA - رئيسة مجلس النواب تدين جريمة الإبادة الجماعية ضد الشعب الأرمني

قالت رئيسة مجلس النواب أنيتا ديميتريو مساء الأربعاء، إن مجلس النواب يدين بشكل لا لبس فيه الجريمة النكراء التي ارتكبت ضد الشعب الأرمني.

أشارت ديمتريو في كلمتها بمناسبة الذكرى الـ 109 للإبادة الجماعية الأرمنية التي أقيمت في الكنيسة الأرمنية في نيقوسيا، إن الإبادة الجماعية للأرمن هي... |

|

CNA - President says tackling energy is biggest goal for competitive economy

The number one problem which Cyprus is facing in relation to is future is to address the challenges arising from energy,in relation to the great... |

|

CNA - سيغريد كاغ: الممر البحري القبرصي يوفر مساعدات إضافية لغزة

قالت سيغريد كاغ منسقة الشؤون الإنسانية وإعادة الإعمار في غزة، إن الممر البحري القبرصي يوفر مساعدات إنسانية إضافية لغزة، لكنه لا يمكن أن يكون بديلا عن الممر البري.

قالت كاغ إنها ناقشت في الأشهر القليلة الماضية بشكل مفصل مع حكومات إسرائيل والأردن ومصر وقبرص مقترحات لتسريع... |

|

Lusa - Business News - Portugal: Top newspaper headlines in Thursday, 25 April

Lisbon, April.25,2024(Lusa)- On the 50th anniversary of the 1974 Carnation Revolution in Portugal, almost everything else has been pushed off the front pages on Thursday.... |

|

Lusa - Business News - Portugal: Stock market soft with Altri down 3.56%

Lisbon,May.26,2023(Lusa)-The Lisbon stock market was down on Friday, maintaining the opening trend, with Atri shares down 3.56% to €4.12 and Corticeira Amorim shares up 2.20% to €10.22.

Around 09:15 in Lisbon, after having opened in a downward trend, the PSI retreated 0.31% to 5,890.41 points, with the share price of 10 shares falling, four rising and two remaining unchanged (REN at €2.47 and Semapa at €14.02).

Altri's net profit from continuing operations reached €19.6 million in the first quarter of this year, a 34.3% year-on-year reduction, the group said in a statement on Thursday.

"The financial performance of the Altri group was influenced by sales volume. Total revenues reached €224.7 million, a decrease of 9.9% compared to the first three months of 2022, influenced by both destocking and the lower contribution of energy sales," the company indicated in the same statement.

Altri's shares were followed by those of Greenvolt, EDP and BCP, which fell 1.56% to €6.39, 1.49% to €4.51 and 1.13% to €0.21.

Other shares that depreciated were those of NOS, CTT and EDP Renováveis, which fell 0.94% to €3.57, 0.89% to €3.34 and also 0.89% to €18.94.

The other three shares (Jerónimo Martins, Navigator and Sonae) were down between 0.36% and 0.58%.

In the opposite direction, Corticeira Amorim's shares were followed by those of Mota-Engil, Ibersol and Galp, which were up 1.05% to €1.92, 0.29% to €6.94 and 0.05% to €10.37.

The main European stock markets were trading mixed today, pending the agreement on the US debt ceiling, where the personal consumption price index, an important benchmark for the US Federal Reserve (Fed), will be released today.

The week in the markets ends with the same focus with which it began: the negotiations on the US debt ceiling.

Sources linked to the negotiations explained on Thursday night that US Congress Democrats and Republicans are "close" to reaching an agreement, which would avoid a suspension of payments, and that they could announce the deal as early as today, according to several US media outlets.

The possible deal would raise the debt ceiling for two years and impose limits on discretionary public spending, except for military or veterans affairs.

Pending such developments, futures of the main Wall Street indicators are flat today after the US market closed mixed on Thursday.

Investors will closely follow the unfolding of US trading in a session in which the macroeconomic agenda brings some relevant commitments, especially in the US, where personal income and spending data for April will be published, variables that are always accompanied by readings of the personal consumption price index, PCE, which is the price variable most followed by the Fed, Link Securities analysts, cited by Efe, recall.

On Thursday, before the markets opened in Europe, it was learned that the German economy contracted by 0.3% in the first quarter of the year, i.e. it entered a technical recession after two consecutive quarters in negative territory.

On the foreign exchange front, the euro opened higher on the Frankfurt exchange market, but at $1.0743, down from $1.0713 on Thursday.

A barrel of Brent crude for July delivery also opened higher on London's Intercontinental Exchange Futures (ICE), quoting at $76.48, up from $76.26 on Thursday and $72.33 on 3 May, a low since January 2022.

MC/ADB // ADB.

Lusa

Agency : LUSA Date : 2023-05-27 03:14:00

|