|

ATA - Rama: Albania receives good practice award for electronic services

TIRANA,April 17/ATA/Albania has received International Social Security Association (ISSA) award for online services at the European Competition 2024, which is taking place in Porto, Portugal.... |

|

MAP - Pedro Sanchez: 2030 World Cup Will Be ‘Great Success’

Madrid -April 17,2024-(MAP)- The 2030 World Cup, of which the Morocco-Spain-Portugal bid was selected by the FIFA Council as the sole candidacy for its organization,... |

|

MAP - Colloque inaugural à Rabat de la 8ème Semaine de la langue espagnole au Maroc

Rabat-17 avril 2024-(MAP)-L’Institut Cervantes de Rabat et l’ambassade du Mexique au Maroc organisent mardi un colloque sous le thème "Vindictas, aportaciones a un canon distinto"... |

|

ANSA - Elkann hails 'record' Ferrari results - Share-ownership plan to be extended to workers worldwide

Ferrari Chairman John Elkann hailed Ferrari's financial and sporting results on Wednesday as he opened the legendary luxury carmakers' shareholders' meeting. ... |

|

ANSA - بينالي البندقية: جناح إسرائيل لن يُفتح حتى الإفراج عن الرهائن

(أنسامد) - أبريل 17 - روما - لن يتم افتتاح الجناح الإسرائيلي في بينالي البندقية الستين حتى يتم الاتفاق على وقف إطلاق النار وإطلاق سراح الرهائن لدى حركة حماس، بحسب لافتة ظهرت خارج الجناح يوم أمس الثلاثاء، عندما كان من المقرر افتتاحه. ... |

|

NNA - HORECA Liban lance sa 28ème édition

ANI-HORECA Liban,le lieu de rencontre annuel des industries de l'hôtellerie et de la restauration,a célébré l'ouverture de sa 28ème édition à la Seaside Arena, Beyrouth.... |

|

NNA - ورشة عمل لجمعية 'تدبير' في مركزها بعندقت عن مفهوم الذكاء الاصطناعي

وطنية- عكار - نظمت جمعية 'تدبير' في مركزها في بلدة عندقت - عكار، ورشة عمل بالتعاون مع جامعة سيدة اللويزة NDU، حول مفهوم الذكاء الاصطناعي AI وكيفية استعماله والاستفادة من تطبيقاته وحسن استخدامها وتعزيز مستوى الكفاءة المهنية والأكاديمية ولزيادة الإنتاجية وإدارة الوقت بطريقة ذكية وسريعة.... |

|

MAP - Le pianiste marocain Marouan Benabdallah enchante le public indien

New Delhi -17 avril 2024-(MAP)- Le pianiste virtuose marocain Marouan Benabdallah a transporté le public indien dans un voyage musical captivant lors d'une soirée mémorable,... |

|

MAP - Le Festival 'Salam Music & Arts' célèbre un jalon important des relations culturelles entre l’Autriche et le Maroc (Brahim El Mazned)

Par:Nadia El Hachimi-Vienne-17 avril 2024-(MAP)-La 22è édition du Festival “Salam Music & arts” célèbre un jalon important des relations culturelles entre l’Autriche et le Maroc,... |

|

ANSA - Messina bridge work to start by summer says Salvini

Responses to environment ministry's 239 queries within 30 days

Work on the Messina Bridge linking Sicily to mainland Italy will start this summer, Transport and Infrastructure Minister Matteo Salvini said Wednesday after the environment... |

|

ANSA - فن الكانتارا فى ترينالى ميلانو

(أنسامد) - أبريل 17 - روما - يعتبر فن الكانتارا من الفنون المفتوحة المشاركة فى أسبوع الفن فى ترينالى ميلانو حيث يتم عرض مجموعة مختارة من أعمال الفنانين الإيطاليين والعالميين من أجيال مختلفة واتجاهات متعددة.

يعد معرض "توليد الرؤى" بمثابة رحلة غير مسبوقة فى أرشيف ألكانتارا... |

|

NNA - Minister of Information honors writer Antoine Ghannoum for contributions to Lebanon’s history

NNA – Caretaker Minister of Information, Ziad Makary, on Wednesday honored renowned writer Antoine Ghannoum as part of "Al-Asala Album" program aired on Tele Liban.... |

|

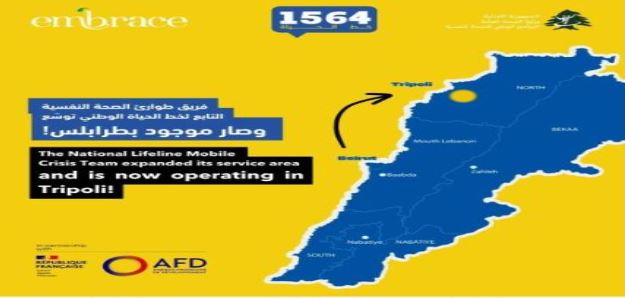

NNA - وزارة الصحة و'امبرايس' أطلقتا فريق طوارىء الصحة النفسية في طرابلس

وطنية-أعلن البرنامج الوطني للصحة النفسية في وزارة الصحة و جمعية'إمبرايس' في بيان، إطلاق فريق طوارىء للصحة النفسية التابع لخط الحياة1564 في طرابلس،في إطار توسيع الاستجابة لحالات الطوارئ النفسية وتوسيع رقعة خدمات الآلية الوطنية للاستجابة لطوارئ الصحة النفسية الوسعي المستمر لدعم خدمات الصحة النفسية في لبنان.... |

|

MAP - Les dimensions géoéconomiques des espaces maritimes de l'Afrique atlantique sous la loupe d’experts à Rabat

Rabat - 17 avril 2024 - (MAP) - Les participants à un panel autour des enjeux géoéconomiques des espaces maritimes de l'Afrique atlantique ont disséqué,... |

|

MAP - Tourisme: Le Maroc en opération de charme à Washington

Washington -17 avril 2024- (MAP) - L'Office national marocain du tourisme (ONMT) a lancé, mardi à Washington, la deuxième étape de son roadshow aux Etats-Unis,... |

|

ANSA - Italy's GDP to grow by 0.9% this year - Confindustria

Industry association revises up forecast from 0.5%

Confindustria's CSC research unit said Wednesday that it expects Italy's GDP to grow by 0.9% this year,which is significantly higher than the forecast of 0.5%... |

|

ANSA - نحو 8 ملايين إيطالي معرضون لخطر تعاطي الكحول

(أنسامد) - أبريل 17 - روما - أفاد المعهد العالي الإيطالى للصحة في التقرير السنوي لمرصد استهلاك الكحول التابع له، إن نحو ثمانية ملايين إيطالي تعاطوا الكحول في عام 2022 بكميات كبيرة بما يكفي لتعريض صحتهم للخطر. ... |

|

NNA - HORECA Lebanon celebrating culinary excellence at horeca lebanon's 28th edition

NNA-HORECA Lebanon,the annual hub for the hospitality and foodservice industries,marked its 28th edition at the Seaside Arena in Beirut with a celebration of culinary excellence.... |

|

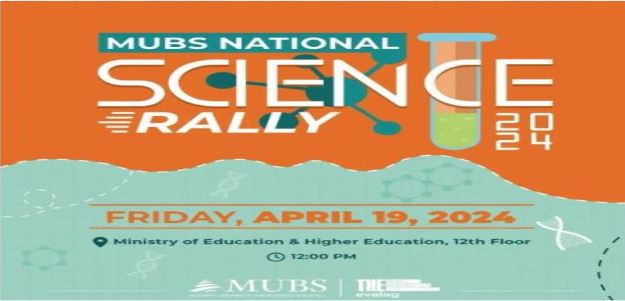

NNA - مباراة في وزارة التربية الجمعة ينظمها علماء وأكاديميين من لبنان وجامعات ستانفورد وكامبريج وأوهايو ستايت

وطنية– أعلنت الجامعة الحديثة للادارة والعلوم في بيان، أنه "في إطار مبادرة المنصة الوطنية للتربية "NEP" التي أطلقتها الجامعة، يتم التحضير للحدث السنوي، وهو إجراء مباراة علمية National Science Rally بمشاركة ثانويات ومدارس من مختلف المناطق اللبنانية بحضور المدير العام لوزارة التربية والتعليم العالي... |

|

MAP - Swedish FM Commends HM the King's Ongoing Commitment to Promoting Values of Coexistence and Inter-faith Dialogue

Stockholm - April 17,2024 - (MAP) - Swedish Foreign Minister Tobias Billström commended the ongoing commitment and leadership role of His Majesty King Mohammed VI... |

|

MAP - Breaking: FRMSAFH, French Dance Federation Sign Partnership Agreement

Rabat-April 17,2024-(MAP)- The Royal Moroccan Federation of Aerobic Sports, Fitness, Hip Hop and related sports (FRMSAFH) and the French Dance Federation signed a partnership agreement... |

|

ANSA - توتنهام يسعى للتعاقد مع ريكاردو كالافيوري

(أنسامد)-أبريل 17-روما-ذكرت تقارير إيطالية أن نادي توتنهام هوتسبير الانجليزي أعرب مؤخرا عن إعجابه بخدمات النجم الايطالي ريكاردو كالافيوري، مدافع نادي بولونيا، في محاولة لضمه هذا الصيف التقارير أفادت بأنه سيكون على توتنهام التغلب على منافسه في السباق نادي يوفنتوس المرشح الأول لضم صاحب ال٢١ عاما... |

|

ANSA - إقتتاح الدورة الـ 62 لمعرض ميلانو للأثاث الفاخر

(أنسامد) -أبريل 17-روما- افتتحت الدورة الثانية والستين من معرض ميلانو للأثاث الفاخر بمشاركة ما يقرب من 2000 عارض من 35 دولة و185 علامة تجارية بما في ذلك القديمة والتي تظهر لأول مرة.

وتتميز نسخة هذا العام أيضًا بما يلي: التركيز بشكل خاص على تصميم المطابخ والحمامات؛... |

|

Lusa - Business News - Portugal: Stock market closes with benchmark up 0.16%, BCP leading gainer

Lisbon,April.17,2024(Lusa)-The Lisbon stock market closed positive on Wednesday,with the PSI index rising 0.16% to 6,234.41 points and BCP leading the gains by advancing almost 2%.... |

|

CNA - الحفريات في بافوس تسفر عن أدلة جديدة على العصر النحاسي الحجري والعصر البرونزي

وفقاً لبيان صحفي صادر عن إدارة الآثار التابعة لوزارة الدولة للثقافة والتي أعلنت الأربعاء انتهاء أعمال التنقيب في الموقع، تم العثور على أدلة مهمة جديدة على العصر النحاسي الحجري والعصر البرونزي من خلال التنقيب في موقع ماكونتا - فوليس -مرسينوديا في منطقة بافوس، على الساحل... |

|

Lusa - Business News - Portugal: Lisbon city council hikes tourist tax to €4 per night

Lisbon, April.17,2024(Lusa)- The Lisbon city council on Wednesday approved the PSD/CDS-PP proposal to increase tourist tax on overnight stays from €2 to €4 per night,... |

|

Lusa - Business News - Portugal: PSD reject govt 'scandal' accusation; no comparison with ex-PS govt

Lisbon, April 17, 2024 (Lusa) - Portugal's Social Democratic Party (PSD) parliamentary leader on Wednesday rejected the idea that there are "scandals and shady cases"... |

|

CNA - النواب القبارصة يصوتون ضد الموافقة على رأي الجمعية البرلمانية لمجلس أوروبا بشأن انضمام كوسوفو إلى مجلس أوروبا

تم أمس الموافقة بالأغلبية على رأي الجمعية البرلمانية لمجلس أوروبا بشأن مسألة انضمام كوسوفو إلى مجلس أوروبا، في الجلسة العامة للجمعية البرلمانية لمجلس أوروبا.

وبحسب بيان صادر عن مجلس النواب، فقد صوت لصالح الرأي 131 عضواً خلال الدورة الثانية للجمعية البرلمانية لمجلس النواب عام 2024،... |

|

CNA - وزيرا الزراعة في اليونان وقبرص يعملان على تعزيز التعاون الثنائي في مجال البيئة

أكد وزيرا الزراعة في اليونان وقبرص الرغبة في تعزيز التعاون الثنائي بين البلدين لحماية البيئة.

ذكر بيان رسمي أن وزيرة الزراعة والتنمية الريفية والبيئة ماريا بانايوتو ووزير البيئة والطاقة اليوناني ثيودوروس سكايلاكاكيس، اجتمعا يوم الثلاثاء على هامش المؤتمر الدولي التاسع لـ"محيطنا" في أثينا. ... |

|

Lusa - Business News - Portugal: Crew of ship Iran seized are 'well - MSC

Tehran, April 17,2024 (Lusa) - Container shipping company MSC confirmed on Wednesday that the crew of the Portuguese-flagged 'MSC Aries', seized on Saturday by Iran,... |

|

Lusa - Business News - Portugal: Government to ask for community fund commission

Lisbon,April.17,2024(Lusa)-The PSD and CDS announced on Wednesday that they would propose the creation of a parliamentary committee to monitor the implementation of the Recovery and... |

|

Lusa - Business News - Portugal: Unions expect 'great moments' on 25 April, 1 May

Lisbon, April.17,2024(Lusa)- CGTP general secretary Tiago Oliveira today expressed his conviction that 25 April and 1 May would be "great moments of affirmation for workers"... |

|

Lusa - Business News - Portugal: South Korea companies invest in renewables, chips - interview

Lisbon, April 17, 2024 (Lusa) - South Korea's ambassador to Portugal, Cho Yeongmoo, expects investments from South Korean companies in the areas of semiconductors ('chips')... |

|

Lusa - Business News - Portugal: IGCP auctions €1.58B in three, eleven-month T-bills

Lisbon, April 17, 2024 (Lusa) - Portugal auctioned €1.580 billion in three-month and 11-month Treasury Bills (BT) on Wednesday, above the maximum indicative amount, ... |

|

Lusa - Business News - Cabo Verde: Pilot strike may affect flights in late April

Praia, April.17,2024(Lusa)- A strike by the pilots of Transportes Aéreos de Cabo Verde (TACV) could affect the company's international flights between 25 and 29 April,... |

|

Lusa - Business News - Guinea-Bissau/Mozambique: Lead growth in Portuguese-speaking Africa

Washington, April 17, 2024 (Lusa) - In its report on the World Economic Outlook, the International Monetary Fund (IMF) predicts that Guinea-Bissau and Mozambique ... |

|

Lusa - Business News - Portugal: Footwear industry overtakes Spain to become 2nd largest in Europe

Porto, April 17, 2024 (Lusa) - The Portuguese footwear industry has overtaken Spain to become the second largest footwear producer in Europe in 2022, ... |

|

CNA - وزيرة الدولة للرعاية الاجتماعية تعرض استراتيجية تعليم الأطفال ورعايتهم في مؤتمر الاتحاد الأوروبي

قالت وزيرة الدولة للرعاية الاجتماعية ماريلينا إيفانجيلو، إن التعليم والرعاية في مرحلة الطفولة المبكرة والوصول إلى خدمات رعاية وتعليم الأطفال بأسعار معقولة وعالية الجودة وشاملة هي الأولوية السياسية العليا للحكومة. ... |

|

Lusa - Business News - Portugal: Stock market trading higher, Mota-Engil up 1.87%

Lisbon, April 17, 2024 (Lusa) - The Lisbon stock market was trading higher on Wednesday, with Mota-Engil shares leading the gains, rising 1.87% to €4.26.... |

|

CNA - الرئيس خريستوذوليديس: لا خيار آخر سوى حل المشكلة القبرصية على أساس الإطار المتفق عليه

رفض رئيس الجمهورية نيكوس خريستوذوليديس الطلب التركي بحل القضية القبرصية التي طال أمدها على أساس "حل الدولتين"، واصفاً ذلك بأنه "غير عقلاني" وأكد موقف حكومته بأنه "لا يوجد، ولن يكون هناك أي حل آخر لتسوية المسألة القبرصية على الإطلاق سوى الإطار المتفق عليه الذي حددته... |

|

Lusa - Business News - Portugal: Top newspaper headlines on Wednesday, 17 April

Lisbon, April.17,2024 (Lusa) - The story of a four-year-old child who was left on a school bus is one of the top stories this Wednesday,... |

|

Lusa - Business News - Portugal: High government borrowing, economy vulnerable - central bank

Lisbon, June 21,2021 (Lusa) - The high level of borrowing by the general government and the increase in contingent liabilities, because of the crisis caused by the pandemic, constitute a vulnerability of the Portuguese economy, the Financial Stability Report of the Banco de Portugal said on Monday.

"The Covid-19 pandemic caused an economic crisis with implications for the financial situation. The support measures were adopted quickly and in a coordinated manner, which prevented the transmission of the crisis to the financial sector," the central bank concluded, adding, however, that "the crisis interrupted the process of adjustment of the Portuguese economy.

According to the report, "the magnitude and persistence of the crisis, along with the dilution in time and the redistribution of the costs of the pandemic between the private and public sectors, led to an increase in debt, particularly in the general government and in the sectors of activity most affected by the crisis.

The report, therefore, identified the main vulnerabilities and risks to financial stability, which, in addition to general government debt, also refers to the "risk of a correction in international financial markets, which may be amplified by high leverage, exposure to assets of lower credit quality and low portfolio liquidity in the non-banking financial sector in the euro area".

In addition, other vulnerabilities include "the withdrawal of support measures in a situation of high borrowing and depressed activity in some sectors", which "enhances credit risk", the "correction of prices in the residential property market in Portugal, which may result, inter alia, from the potential retraction in demand for property by non-residents, which may be associated with a deterioration in international financing conditions", and the fact that in the commercial property market, "there may be an additional fall in prices following the 2020 occurrence for some segments (retail and hotels)".

Lastly, the bank also warned of the "prospects of low profitability in the banking sector and reinforcement of the link to the public sector, through increased exposure to public debt and the granting of credit with public guarantees".

"Assessed overall, the vulnerabilities and risks show interdependence between economic sectors, which should be taken into account in the formulation of policies to promote financial stability," the bank said.

MPE/ADB // ADB.

Lusa

Agency : LUSA Date : 2021-06-22 10:23:00

|